China Pencils (HS: 960910) 2025 Annual Analysis Report

“China remains the world's largest pencil producer. In 2025, its pencil exports saw a decline in both value and volume, showing clear seasonal trends. While the U.S. is the top market, emerging regions like Latin America and Southeast Asia are showing growth potential. To maintain competitiveness, China's pencil industry must focus on technological upgrades and adapting to shifting global trade dynamics.”

The pencil is a familiar object to us all. We begin interacting with pencils from the moment we start learning to read and write. As we grow and gain life experience, we discover that the uses for pencils are increasingly diverse, and their varieties continue to multiply.

A pencil is a writing or drawing instrument with a core of graphite (or pigment-added clay) and a wooden barrel. The latest manufacturing advancements in 2025 have achieved versions that are lead-free, utilize biodegradable wooden barrels, and incorporate digital-compatible cores.

Reportedly, China is the world's largest pencil producer, accounting for over 50% of global pencil output. According to Big Trade Data, China's total pencil export value in 2025 was $586 million, a year-on-year decrease of 13.66%. The export volume was 119.3 thousand tons, down 6.72% year-on-year. Within this total, colored pencil exports amounted to $303 million, constituting 51.73% of the total export value, while ordinary pencil exports were$283 million, making up 48.27%.

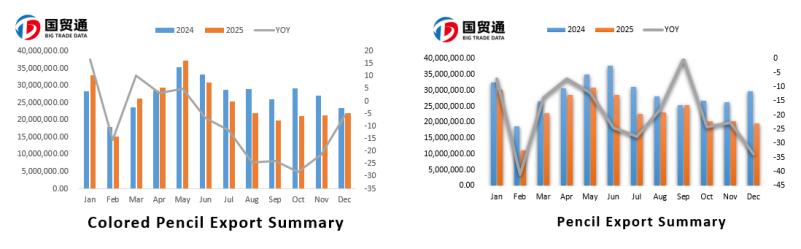

Analyzing the monthly trends throughout the year reveals significant seasonal fluctuations, characterized by a cyclical pattern of higher values in the initial months, lower values later, and volatility in the middle. The peak export values for the year were concentrated between March and June, with May being particularly prominent, reaching a total export value of $68.01 million. Subsequently, export values exhibited a downward trend, dropping to $41.6772 million by December.

Among these, China's colored pencils (HS: 96091010) showed considerable overall volatility. The highest export value occurred in May, reaching $37.15 thousand, while the lowest was in February, at $15.23 thousand—a difference of over twofold. This underscores the distinct seasonal characteristics of this product category.

In contrast, the trend for China's ordinary pencils (HS: 96091020) was relatively stable. The peak export value for this category also appeared in May, reaching $860 thousand. This presents a sharp contrast to the sustained downward trend observed for colored pencils (HS: 96091010).

From a market distribution perspective, China's pencil exports are quite diversified. Key destinations span across Asia, including Thailand, Malaysia, Indonesia, and the Philippines; the Middle East, notably the United Arab Emirates; Europe, encompassing Germany, Italy, Russia, and the Netherlands; and the Americas, primarily the United States. These top ten markets collectively accounted for 70% of the total annual export value.

Notably, the United States alone represented 20.5% of the total annual export value. The data indicates that while the U.S. market experiences considerable volatility, it remains the unequivocal top export destination.

Furthermore, markets within the Americas such as Colombia, Peru, and Chile are also worthy of attention for current suppliers. Although these markets rank outside the top ten overall, they demonstrated strong growth momentum in specific months during the overall export period. Notably, Peru's exports exceeded $2.65 million in September, and Chile's surpassed $1.77 million** in October, fully highlighting the potential of these markets.

Secondly, although export volumes to Pakistan and Bangladesh are not substantial, their status as populous nations makes them markets well worth the attention of domestic suppliers.

It is important to note that tariff issues in the U.S. market may lead to increased product prices stateside, resulting in more intense competition, order shifts, or reductions within that market. To circumvent tariffs, many buyers might opt for alternative sourcing from regions like Southeast Asia and Latin America. However, these emerging markets—Southeast Asia, the Middle East, and Latin America—though experiencing relatively rapid demand growth, are more price-sensitive and tend to favor mid-to-low-end products.

Overall, while maintaining its cost advantages, China's pencil foreign trade sector needs to leverage measures such as technological upgrading, green transformation, and cultural empowerment to break through growth bottlenecks and adapt to the dynamic changes in the global market.

(Note: The above data includes pencils under customs codes HS 96091020 and colored pencils under HS 96091010.)

As China's first data company, Big Trade Data provides import-export customs data for over 90 countries from 2010 to the present. It enables precise online analysis of import-export market distribution, detailed transaction records of trading enterprises, specific volume-price analysis, supply cycles, and more. It offers reliable, evidence-based data for major foreign trade enterprises and industry consulting firms.