Latest Annual Import and Export Report on Chinese Virgin Peanut Oil (HS: 15081000)

“China's peanut oil (HS 15081000) dominates global production, holding a key pricing position. While 2025 export volumes declined year-on-year, they showed strong recovery in the second half, with premium markets like the EU and New Zealand driving value. Leveraging its cost and high-oleic acid technology, China is poised to strengthen its role as the global benchmark for healthy vegetable oils through high-value organic and cold-pressed exports.”

Peanut oil (HS: 15081000) is a vegetable oil extracted from peanut seeds. Valued for its unique aroma, balanced fatty acid composition, and versatility in cooking, it is an easily digestible edible oil. The unsaturated fatty acid content in peanut oil exceeds 80%, comprising approximately 41.2% oleic acid and 37.6% linoleic acid. Saturated fatty acids such as palmitic acid, stearic acid, and arachidic acid constitute about 19.9%. Additionally, peanut oil is rich in beneficial components including sterols, tocopherol, phospholipids, vitamin E, and choline.

China, producing over 60% of the world's peanut oil, is unequivocally the leading global producer. Customs data indicates an overall upward trend in China's peanut oil exports. Although a sharp decline occurred in 2022, exports rebounded strongly in 2023, recovering to a high level. This market shift is closely linked to the global pandemic and national policy changes.

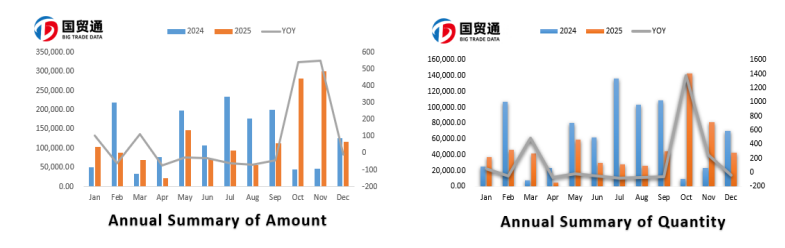

According to the latest data, China's total peanut oil exports from January to November 2025 amounted to 541.8 tons, representing a year-on-year decrease of 28.27%. The total export value was $1.348 million, a year-on-year decrease of 10.94%. While the overall export performance declined compared to 2024, data from the second half of 2025 shows an overall upward trend in export volume.

Export values saw significant increases in October and November, accounting for 43.2% of the total annual export value and establishing these months as the primary export period for the year. Overall, export values experienced considerable volatility in April and May: April's total export value fell to an annual low of just $21,600; May saw a rebound to $147,600, a month-on-month increase of 582%; By October and November, export values peaked for the year. In summary, exports demonstrate a pattern of volatile growth. These market fluctuations and seasonal characteristics are closely related to the latest international inspection standards.

Reports indicate that the European Union further reduced its aflatoxin limit by 20% in 2025. Concurrently, the annual qualified detection rate for relevant Chinese products reached a high of 99%. Influenced by these factors, China's peanut oil exports to the EU market broke the situation of zero sales recorded in 2024.

In terms of market distribution, the primary export markets are concentrated in Asia, specifically Malaysia and Hong Kong, China. These two markets account for 74.46% of the total export value and 87.09% of the total export volume. The remaining markets primarily include Canada, the United States, South Korea, among others.

However, from the perspective of average market prices, markets such as New Zealand, Solomon Islands, Belarus, and Cape Verde have performed notably well, with the highest price reaching $7.29. Following these, markets like Canada, the United States, Singapore, Australia, and the United Kingdom show average prices in the range of $4.45 - $4.87. Consumers in these markets have higher requirements for product quality, making them key markets for Chinese peanut oil exports to enhance profitability. It is important to note that there remains room for technical improvement. For instance, advancements are needed in the research, development, and production of products such as high-oleic acid oil, cold-pressed + organic peanut oil, and oils enriched with plant sterols and vitamin E.

Overall, Chinese peanut oil (HS: 15081000) firmly holds a global price-anchoring position based on three core advantages: "60% of global production, 15% lower cost compared to similar products, and globally leading high-oleic acid technology." In the future, leveraging three premium value pathways—high-oleic acid, cold-pressed, and organic—its export value is expected to continue growing. Chinese peanut oil will further solidify its core position as the global "pricing anchor for healthy vegetable oils."

As China's first data company, Big Trade Data provides import and export customs data for over 90 countries from 2010 to the present. It enables precise online analysis of import/export market distribution, detailed transaction records of trading enterprises, specific volume-price analysis, supply cycles, and more. It supplies reliable foundational data for major foreign trade enterprises and industry consulting firms.