Analysis of China's Hair Dye Exports (HS Code: 33052000) in 2025

“”

Traditionally, the main consumer group for hair dyes has been middle-aged and elderly people covering gray hair. However, in recent years, the demand boundary has continued to expand. Driven by global aging and the appearance-based economy, the hair dye market is entering a long-term cycle of "volume growth and price increase."

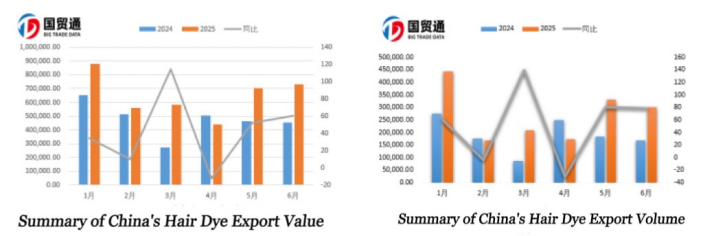

China's hair dye foreign trade presents a pattern of "export-oriented, supplemented by imports," with the export value being approximately 2.62 times the import value. According to customs data, the total export value from January to June 2025 was $3.9 million, a year-on-year increase of 36.37% compared to the same period in 2024. The total export volume was 1,626 tons, a year-on-year increase of 42.42%. The total import value was $1.49 million, a year-on-year decrease of 0.59%, and the total import volume was 171 tons, a year-on-year decrease of 14.11%.

Based on the first half of the year's data, China's hair dye exports show significant fluctuations. The peak occurred in January, with an export value of $880,000, accounting for 22.52% of the total export value for the first half of the year. The lowest point was in April, with an export value of $440,000, accounting for 11.3% of the total, a decrease of 49.8% compared to January. Overall, hair dye exports exhibited a trend of "starting high then falling - slight rebound - falling again," with three consecutive months of decline after January, a brief rebound in May, and a drop again to $730,000 in June. This change reflects both seasonal factors and shifts in product and customer structure.

Data from the first half of 2025 shows that China's hair dye export market is mainly concentrated in Southeast Asia, primarily Indonesia, Thailand, and Vietnam, accounting for 50.53% of the total market. Among them, Indonesia accounts for 28.64%, ranking first. Markets such as India and North Korea also show strong demand, accounting for 15.63% and 13.98% of the market, respectively.

In terms of average market prices, Fiji, Hong Kong (China), and Japan reflect high-end customized demand. From the perspective of transaction frequency, North Korea and Thailand demonstrate stable trade relationships with China. Meanwhile, markets such as Fiji and Saudi Arabia are increasingly seeing single transaction amounts exceeding $1,000, highlighting the significant growth of high-value-added products in exports.

Currently, China's hair dye industry faces challenges such as the U.S. imposing an additional 25% Section 301 tariff on finished hair dye products from China and an extra 6.5% tariff on dyes like p-phenylenediamine. The EU's 2025 REACH update further reduces limits for 21 types of dyes by 20-30%, increasing compliance costs by 5-8%. In the future, China's hair dye industry needs to diversify its market development and enhance green technology upgrades to circumvent trade barriers such as tariffs.

Overall, China's hair dye industry exhibits a trade pattern of "export-oriented, supplemented by imports," with both export volume and value significantly higher than imports in 2025. China's hair dye raw material industry is in a stage of "volume growth and quality improvement": demand benefits from the silver economy and trendy color dyeing, while the supply side is accelerating upgrades to low-irritation and green processes. However, high-end monomers still heavily rely on imports.

Over the next five years, leveraging green formula upgrades, population dividends in emerging markets, and localized production capacity, China's hair dye exports are expected to maintain double-digit growth. During this process, companies must simultaneously address three macro variables: tariffs, green barriers, and exchange rates, while also benefiting from the excess dividends brought by increased industry concentration.

As China's first data company,Big Trade Data Ltd. provides import and export customs data for over 90 countries from 2010 to the present. It enables precise online analysis of import and export market distribution, detailed transaction details of import and export enterprises, specific volume and price analysis, supply cycles, and more. It offers reliable reference data for various foreign trade enterprises and industry consulting companies.

(This article is an original piece by Guomaotong; please indicate the source when reposting.)