China's Fitness Equipment (HS: 950691) Export Summary for the First Half of 2025

“Fitness equipment refers to a broad category of sports apparatus used for physical training, classified into single-function machines (e.g., treadmills, rowing machines, elliptical trainers) and multi-functional machines. China dominates the global trade of fitness equipment, leading in export volume while continuously enhancing competitiveness through technological innovation, supply chain advantages, and policy support.”

Fitness equipment refers to a broad category of sports apparatus used for physical training, classified into single-function machines (e.g., treadmills, rowing machines, elliptical trainers) and multi-functional machines. China dominates the global trade of fitness equipment, leading in export volume while continuously enhancing competitiveness through technological innovation, supply chain advantages, and policy support.

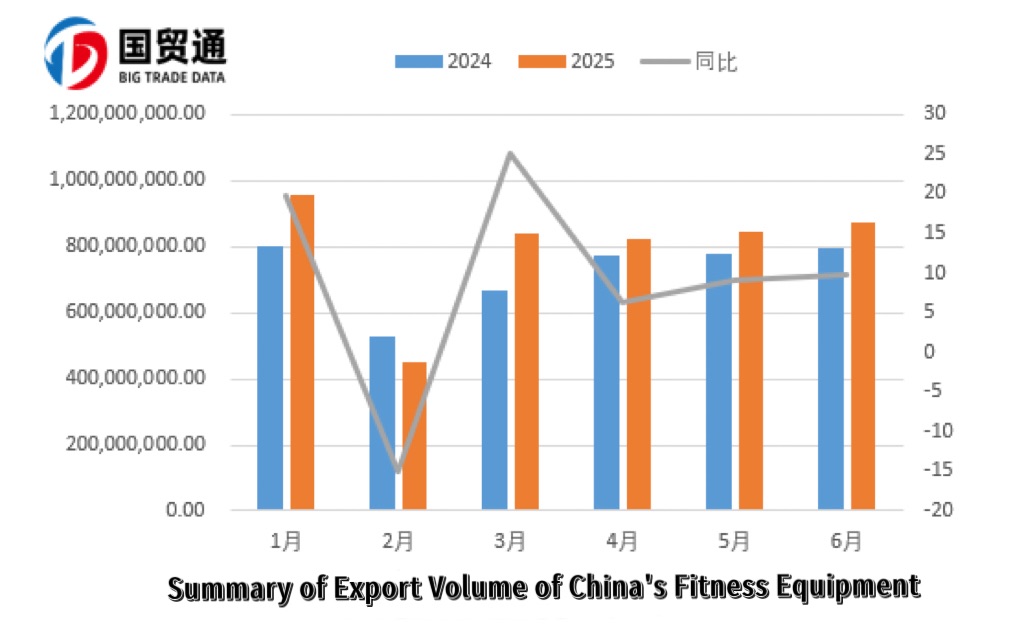

According to customs data, China's fitness equipment (HS: 950691) exports totaled $4.784 billion from January to June 2025, marking a 10.2% year-on-year increase compared to the same period in 2024. The first quarter saw a 12.36% growth, while the second quarter grew by 8.37%.

By product category, HS: 950691119 (Other fitness and rehabilitation equipment) dominated exports, accounting for $2.78 billion (58.1% of total exports). Although HS: 95069111 (Treadmills) represented only 14.6% of total exports, it exhibited the fastest growth rate.

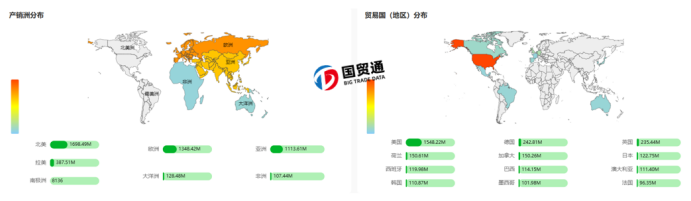

In terms of markets, the top three destinations—the U.S., Germany, and the UK—comprised 44.3% of total exports, while the top ten markets accounted for 68.5%, highlighting China's heavy reliance on developed economies in Europe and North America.

However, emerging markets showed notable growth:

•Southeast Asia: Vietnam (56% QoQ growth) and Malaysia (20.5% QoQ growth).

•South America: Brazil (51% QoQ growth) and Colombia (35.9% QoQ growth).

•Africa: Though starting from a low base, Nigeria (35.4% QoQ growth) and Kenya (42.9% QoQ growth) demonstrated high potential.

•Middle East: Saudi Arabia and the UAE also saw strong demand growth.

Overall, China's fitness equipment exports in the first half of 2025 followed a pattern of developed markets leading with emerging markets supplementing growth. Despite the U.S. eliminating the "de minimis tariff exemption" (effective May 2025) and imposing a 120% ad valorem tariff, which raised cross-border e-commerce costs (some categories, like sportswear, face tariffs as high as 50%), the fundamental trade structure remained unchanged. In the short term, volatile U.S. tariffs warrant caution; in the long term, market diversification, supply chain optimization, and product innovation will be key to addressing new challenges.

Looking ahead, as global health-conscious consumption rises and China advances its high-end manufacturing capabilities, the country's fitness equipment exports are poised to transition from volume dominance to quality leadership.

China Big Trade Data Trade Country Overview:

China Big Trade Data Importer Overview:

Colombia Import Data Overview:

As China's first trade data provider, Big Trade Data Ltd. offers import/export customs data from over 90 countries (2010–present), enabling precise analysis of market distribution, enterprise-level trade details, volume-price trends, and supply cycles. Our data serves as a reliable foundation for foreign trade firms and industry consultants.