Analysis of China's Laundry Soap (HS: 34011910) Imports and Exports in 2025

“Currently, Chinese laundry soap faces challenges such as squeezed market share in the premium segment by liquid detergents in Europe and the U.S., relatively low market penetration, and the need for technological standard upgrades. However, China's laundry soap exports can leverage production capacity and innovation to establish differentiated advantages in niche areas like fragrances and natural ingredients, tapping into the growth potential of emerging markets. In the future, through technological iteration and green certification, it may break through the barriers of the premium market and transition from a "cost-driven" model to one focused on "brand and technology exports."”

Laundry, as an indispensable part of daily life, has undergone significant changes in the forms of cleaning products over decades of evolution. From the perspective of modern chemical synthesis development, laundry products have primarily gone through three generations: the first generation being laundry soap, the second being laundry powder, and the third being laundry detergent. As one of the traditional cleaning products, laundry soap currently exhibits a dual development trend of "niche breakthroughs" and "premium upgrades" in the cleaning market, particularly standing out in segments such as fragrance and environmental protection.

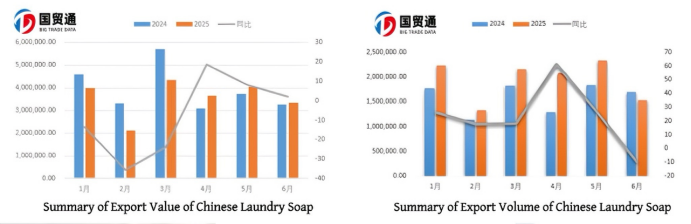

According to customs data, the total export value of soap in the first half of 2025 was $548 million, with HS:34011990 (unspecified bar soap) accounting for 94.84% of the total exports, while laundry soap (HS:34011910) exports amounted to $21.429 million, representing 3.91% of the total soap exports.

Data from 2020 to 2023 show that China's laundry soap exports had been growing steadily. However, from 2024 to June 2025, a decline emerged, with a 40.31% year-on-year drop in 2024 compared to 2023 and a 9.47% decline in the first half of 2025 compared to the same period in 2024. The sharp decline in China's laundry soap exports in 2024 was not due to a single factor but rather the combined impact of multiple challenges, including "increased tariffs in Europe and the U.S. + geopolitical shipping costs + substitution by Southeast Asia + rising domestic costs." This market shift has directly affected the global trade positioning of Chinese laundry soap.

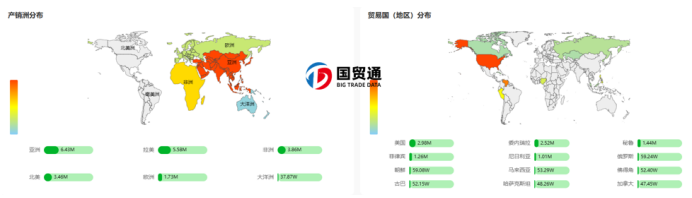

Customs data reveal that in the first half of 2025, the U.S. market showed signs of gradual recovery after a sharp drop due to policy-related issues, while Venezuela in Latin America stood out with a remarkable 1,721.24% growth compared to the same period in 2024. Additionally, emerging markets in Africa, such as Nigeria and Senegal, demonstrated significant growth, while Asian countries like the Philippines and Malaysia also exhibited strong market demand. The Middle Eastern markets, including the UAE and Saudi Arabia, remained stable. Notably, the European market currently accounts for less than 5% of total exports.

Currently, Chinese laundry soap faces challenges such as squeezed market share in the premium segment by liquid detergents in Europe and the U.S., relatively low market penetration, and the need for technological standard upgrades. However, China's laundry soap exports can leverage production capacity and innovation to establish differentiated advantages in niche areas like fragrances and natural ingredients, tapping into the growth potential of emerging markets. In the future, through technological iteration and green certification, it may break through the barriers of the premium market and transition from a "cost-driven" model to one focused on "brand and technology exports."

Overall, laundry soap is evolving from a "basic cleaning product" to a "carrier of quality living." Through technological innovation and deeper market segmentation, it can solidify its unique position in the cleaning market.

China Big Trade Data Trade Country Overview:

China Big Trade Data Importer Overview:

Colombia Import Data Overview:

As China's first trade data provider, Big Trade Data Ltd. offers import/export customs data from over 90 countries (2010–present), enabling precise analysis of market distribution, enterprise-level trade details, volume-price trends, and supply cycles. Our data serves as a reliable foundation for foreign trade firms and industry consultants.