China Compound Fertilizer Export Data Analysis for the First Half of 2025

“In 2023, the global compound fertilizer market was valued at $43.837 billion, with a projected compound annual growth rate (CAGR) of 6.62% from 2023 to 2028. As more countries implement agricultural development policies encouraging the replacement of traditional fertilizers with compound fertilizers, international demand is further stimulated.”

Fertilizer is a crucial agricultural input with significant implications for food security. As global population growth and food demand continue to rise, the need for higher crop yields and quality has driven substantial increases in domestic and international demand for compound fertilizers.

Compound fertilizers contain two or more essential nutrients (nitrogen, phosphorus, and potassium) and offer advantages such as high nutrient content, minimal secondary components, and excellent physical properties, playing a vital role in promoting stable and high-yield crop production. In 2023, the global compound fertilizer market was valued at $43.837 billion, with a projected compound annual growth rate (CAGR) of 6.62% from 2023 to 2028. As more countries implement agricultural development policies encouraging the replacement of traditional fertilizers with compound fertilizers, international demand is further stimulated.

China’s Compound Fertilizer Exports in the First Half of 2025

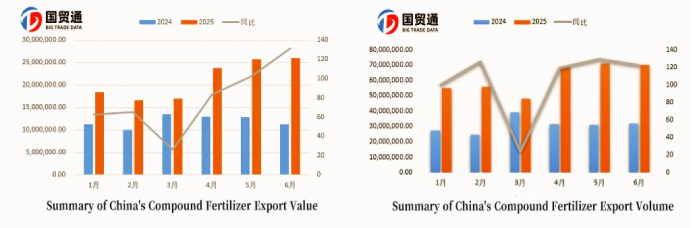

According to customs data, China's compound fertilizer exports (HS Code: 31059090) from January to June 2025 reached approximately $127 million, an increase of $55.69 million (77.72%) year-on-year.

The average export price during this period was $0.35/kg, down 10.75% compared to the same period in 2024.

The average export price of China's compound fertilizers declined in the first half of 2025. The main reasons include: the continuous expansion of China's compound fertilizer production capacity in the first half of 2025, resulting in a loose market supply, with companies generally adopting price reduction and promotion strategies to digest inventory; key production costs such as coal and natural gas remained low in the first half of the year, while international prices of raw materials like phosphate rock and potash fell, creating room for the decline in compound fertilizer prices; China continued to implement fertilizer export quota management in 2025 while explicitly banning fertilizer exports to India, leading exporters to shift to price-sensitive markets in Southeast Asia and Africa.

According to export statistics by country and region, Vietnam was the largest export destination for China's compound fertilizers from January to June 2025, with an export value of $29.96 million, followed by South Korea and Mexico, with export values of $5.93 million and $3.49 million, respectively. Among these, exports to Turkey from January to June 2025 increased by 314.18% year-on-year. The reasons include: China's compound fertilizer production costs being lower than those of local Turkish enterprises, Turkey's market having strong demand for cost-effective products, and China's compound fertilizers being relatively competitive in terms of price; Turkey's "2025-2027 Agricultural Support Program," under which the government provides "fertilizer vouchers" as subsidies to small and medium-sized farmers, directly boosted demand for compound fertilizers; in addition, at the beginning of 2025, Turkey introduced a new agricultural strategy to comprehensively advance agricultural policy reforms, further stimulating demand for compound fertilizers. Furthermore, Malaysia, the Philippines, Laos, New Zealand, Kazakhstan, Uzbekistan, and Kenya all achieved growth rates exceeding 300% year-on-year.

From a regional trade perspective, Asia and Latin America were the main export destinations for China's compound fertilizers, accounting for 84.16% of total exports. From January to June 2025, exports to all major regions achieved growth: exports to Asia reached $90.98 million, up 108.45% year-on-year; exports to Latin America reached $16.19 million, up 24.34% year-on-year; exports to Europe reached $8.53 million, up 26.49% year-on-year; exports to Africa reached $6.45 million, up 20.99% year-on-year; exports to Oceania reached $3.38 million, up 83.81% year-on-year; and exports to North America reached $1.81 million, up 69% year-on-year.

In terms of major exporting provinces and cities, the top five regions by export value from January to June 2025 were Shandong, Jiangsu, Shaanxi, Henan, and Sichuan, accounting for a combined 62.43% of total exports. These were followed by Hebei, Jiangxi, Tianjin, Beijing, and Hunan, with export values of $5.14 million, $5.13 million, $4.89 million, $4.11 million, and $3.45 million, respectively.

Global Market Distribution and Characteristics of Compound Fertilizers

Industry Chain Overview

1.Upstream (Raw Materials):

•Key inputs: Coal, phosphate rock, urea, potassium chloride.

•Leading suppliers: Xingfa Group, Hualu-Hengsheng, Yuntianhua, Salt Lake Co.

2Midstream (Production):

•Core manufacturers: Stanley, Kingenta, Xin Yangfeng, Batian, Hongsifang, Yuntu Holdings.

3.Downstream (Application):

•Primary sectors: Agriculture, landscaping.

Major Global Markets

1.Asia (40%+ market share): Largest and fastest-growing demand.

2.North America (~20%): Strict quality requirements (U.S. & Canada prioritize precision and eco-efficiency).

3.Europe (5%+ CAGR): Green transition driven by EU’s "Farm to Fork" strategy.

4.Emerging Markets (Africa & Latin America): High import dependency; rising demand for cost-effective solutions.

Market Development Recommendations for Fertilizer Companies

Focus on high-growth markets: Vietnam, Turkey, Thailand, Malaysia, Philippines, Laos, New Zealand.

Leverage trade intelligence tools (e.g., Big Trade Data’s AI-powered DaaS system) to:

Identify high-potential buyers (e.g., Malaysian importers).

Analyze procurement patterns (volume, price, logistics).

Track supply chain trends and competitor activity.

Extract contact details (email, LinkedIn, WhatsApp) for direct engagement.

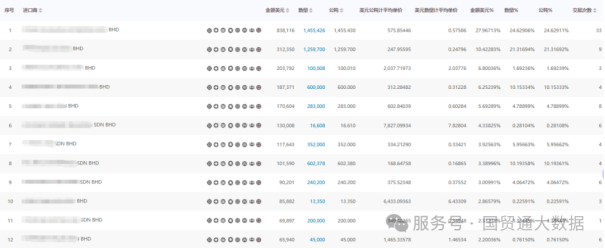

Malaysian Compound Fertilizer Buyers

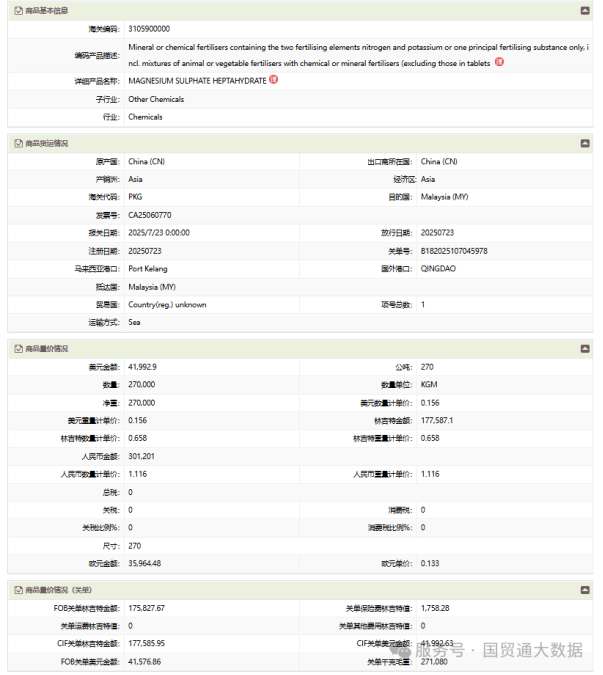

Identify potential buyers based on transaction frequency and transaction amount, and directly analyze their purchasing habits by examining detailed buyer information such as product details, port information, volume-price data, shipping methods, quantity, amount, and weight.

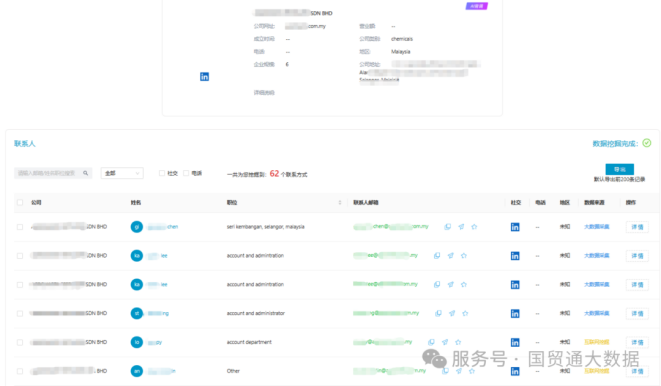

Malaysian Buyer Profiles

Conduct tracking analysis on the enterprise, including its trade trends, upstream suppliers, competitors, and importer RFM (Recency, Frequency, Monetary) analysis to gain comprehensive customer insights.

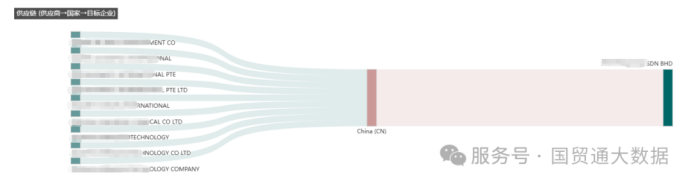

Supply Chain Analysis

Accurately identifying high-potential clients and obtaining their contact information is crucial!With Big Trade Data's Global Trade Search function, you can instantly uncover buyer contact details, including;Job Title、Email、Phone Number、LinkedIn Profile、WhatsApp.

Key Export Compliance Considerations

1.Packaging & Labeling: Must meet corrosion/waterproofing standards and destination-country language requirements (e.g., Arabic for Middle East, Spanish/Portuguese for Latin America).

2.Required Documents:

◎Export license (MOFCOM registration).

◎Tariff quota approval.

◎MSDS certification.

3.Country-Specific Certifications:

Nigeria: SONCAP

South Africa: SABS (4–6 weeks processing)

Egypt: GOEIC (composition analysis report)

India: Fertilizer Import License (6-month validity)

EU: REACH/CLP compliance for hazardous materials.

Outlook & Strategic Advice

While global agrochemical demand is rising, challenges persist. Companies must:

★Monitor trade policy shifts (e.g., export bans, subsidies).

★Invest in R&D for sustainable and localized solutions.

★Adopt data-driven strategies to optimize supply chains and customer targeting.

Big Trade Data Ltd., a leading global trade intelligence provider with 21 years of expertise, offers precision analytics for 12,000+ enterprises, empowering fertilizer exporters with actionable market insights.