Big Trade Data: Analysis of China's Casein Imports and Exports (HS Code: 35011000) in 2025

“China's casein market is large yet heavily import-dependent, with 2025 imports totaling $120 million (down 16.64%) while exports fell sharply by 66.37%. New Zealand dominates imports, supplemented by Ireland and European suppliers across low to premium price segments. Though facing cost and technological challenges, the domestic industry is developing through policy support amid strong consumer demand. Big Trade Data provides detailed customs analysis for this market.”

Casein is a high-quality, complete protein that is digested slowly, providing a sustained release of amino acids. It is particularly valuable for individuals who require prolonged inhibition of muscle breakdown, such as athletes and fitness enthusiasts, and also serves as an important functional ingredient in the food industry. For most people, consuming dairy products through a regular diet is the best way to obtain casein; for those with specific nutritional needs, casein supplements offer a convenient and effective alternative. Individuals with allergies or digestive issues should consult a doctor or nutritionist.

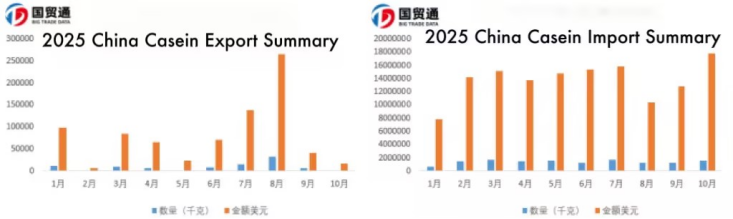

China is one of the largest global markets for casein but is not a major production powerhouse. The domestic market relies heavily on imports, yet the local industry is also seeking development driven by policy and market dynamics. According to customs data, China's casein exports from January to September 2025 amounted to $797,000, a decrease of 66.37% compared to the same period in 2024, with the total export volume at 99 tons, down 62.77% year-on-year.

On the import side, the total import value reached $120 million by September 2025, a decline of 16.64% year-on-year, while the total import volume was 12,700 tons, down 29.32% compared to the previous year.

In terms of market distribution, exports are primarily concentrated in Asian countries such as South Korea, Thailand, Vietnam, Pakistan, the Philippines, and Malaysia. Imports mainly originate from New Zealand, Ireland, France, the Netherlands, and Germany. Among these, New Zealand holds an irreplaceable leading position in both volume and value, followed by Ireland, which serves as an important supplement to the New Zealand market, meeting the demand for high-quality products.

From a price perspective, markets including New Zealand, France, Belarus, and Italy have an average price below $10 per unit, accounting for 72.71% of the total import value and representing the primary sources of imports. Markets such as Ireland, the Netherlands, the United States, and Spain fall in the mid-to-high-end range, with average prices between $10 and $20, accounting for 27.58% of the total market value. Markets like Germany, Ukraine, Denmark, and Austria, with average prices above $20, constitute a niche segment despite holding less than 0.5% of the market share.

Overall, China's casein market exhibits a typical pattern of "large market size but weak domestic production." Driven by consumption upgrades and health trends, the market remains heavily import-dependent. Although the local industry faces multiple challenges related to costs, technology, and environmental sustainability, it is actively striving to catch up and seek breakthroughs, encouraged by national policies and market potential. The future development of China's casein industry will depend on whether significant progress can be made in reducing costs, improving technical processes, and achieving green production.

As China's first data company, Big Trade Data provides import and export customs data for over 90 countries from 2010 to the present. It enables precise online analysis of import and export market distribution, detailed transaction records of enterprises, and specific volume-price analyses and supply cycles. This offers reliable foundational data for various foreign trade enterprises and industry consulting firms.