Analysis of China's Shampoo (HS: 33051000) Imports and Exports for 2025

“This analysis of China's shampoo trade under HS code 33051000 for 2025 reveals a sector in transformation, with exports growing 16.79% to $137 million and imports rising 10.06% to $309 million during Jan-Aug 2025. China's export strategy focuses on basic formulations in large packaging to Asian markets, while imports concentrate on premium functional products from Japan, Korea and European countries. The market is evolving from simple cleaning agents to value-added products emphasizing eco-friendly surfactants, anti-hair loss solutions, and tear-free children's formulas, with projected 25% growth in demand for bulk shampoo driven by Southeast Asia's manufacturing growth.”

Shampoo falls under the sub-category of "Manufacture of Daily Chemical Products" within the "Manufacture of Raw Chemical Materials and Chemical Products" industry. In recent years, with the continuous improvement of living standards, daily necessities such as shampoo have also been constantly upgraded. The demand for mid-range and high-end shampoo products has been steadily increasing, driving the continuous expansion of the industry scale. Shampoo has evolved from a simple cleaning agent into a essential fast-moving consumer good possessing multiple values encompassing health, cosmetics, mood, and environmental protection. It supports a market worth hundreds of billions and employment in the millions, making it a high-potential category where China is rapidly scaling volume in the global foreign trade market.

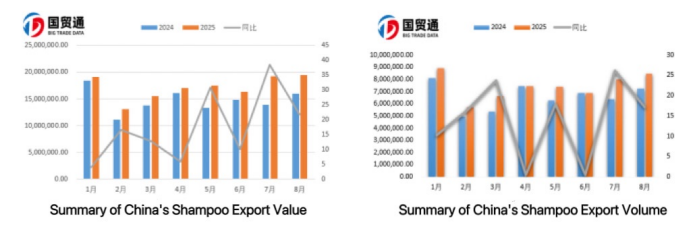

According to customs data, China's shampoo exports have shown a fluctuating but overall upward trend over the past five years, while imports have remained relatively stable.

From January to August 2025, the cumulative export value of Chinese shampoo reached USD 137 million, a increase of 16.79% compared to the same period in 2024. The total export volume was 5.95 tons, representing a growth of 13.29% year-on-year. The import value was USD 309 million, a rise of 10.06% year-on-year, while the import volume was 3.78 tons, an increase of 14.16% compared to the same period last year.

Regarding market distribution, China's shampoo exports are primarily concentrated in regions such as the United States, Hong Kong (China), Taiwan (China), the United Kingdom, Vietnam, Russia, North Korea, the United Arab Emirates, Saudi Arabia, and Australia. The Asian market dominates overall, accounting for 51.55% of total export volume.

The import market is mainly composed of Japan, South Korea, Spain, France, Australia, Germany, Thailand, the United States, Taiwan (China), and Turkey, which together account for 91.83% of total import volume, maintaining a long-term trade surplus. Influenced by the rise of textile and daily chemical contract manufacturing in Southeast Asia, the annual demand for large-packaged basic shampoo in China is projected to grow by over 25%.

China's shampoo exports are rapidly scaling volume through "basic formulations + large packaging," whereas imports focus on premium "high-unit-price functional" products. Over the next five years, the industry will primarily concentrate on three major segments: eco-friendly surfactants, anti-hair loss and repair, and tear-free formulas for infants and children. Shampoo enterprises that capitalize on the two main trends of functional formulation upgrades and green packaging will drive the market's sustained development.

Big Trade Data, as China's first data company, provides import and export customs data for over 90 countries from 2010 to the present. It enables online precise analysis of import and export market distribution, detailed transaction records of importing and exporting enterprises, specific volume and price analysis, supply cycles, and more. It provides reliable foundational data for major foreign trade enterprises and industry consulting companies.