Latest 2025 Export Analysis of Chinese Fireworks and Firecrackers (HS Code: 36041000)

“This report analyzes China's 2025 fireworks and firecrackers exports (HS 36041000), highlighting China's dominant global market share of 60%-70%. It details key export markets, with the U.S. being the largest (over 30% share) and Europe showing strong demand. The analysis notes price sensitivity, competition intensity, and risks from over-reliance on the U.S. market and potential tariff impacts. It concludes that the industry maintains its leading position globally and is poised to leverage advantages in environmental standards, electronic control, and cultural customization for continued growth.”

Fireworks and firecrackers are traditional entertainment products, essentially pyrotechnic arts and crafts, that utilize gunpowder-based formulations to produce effects such as sound, light, color, and smoke upon ignition or explosion. Originating in China's Sui and Tang dynasties, they were initially used for warding off evil spirits and praying for blessings. They later evolved into a folk art form integral to traditional festivals like the Spring Festival and Lantern Festival.

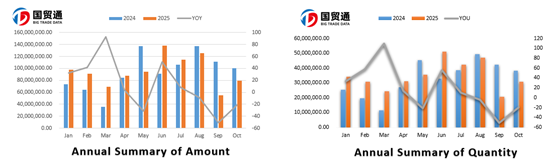

As a quintessentially Chinese product, fireworks and firecrackers hold a significant position in global trade. China's exports account for 60%-70% of the world's total volume. According to customs data, China's total fireworks and firecracker exports from January to October 2025 reached 347,000 tons, a year-on-year increase of 5.29%, with a total export value of $952 million, marking a modest growth of 0.96%. The average market price saw a decrease of 5.43% compared to the same period in 2024.

In terms of market distribution, the United States is the largest export market for Chinese fireworks and firecrackers, accounting for over 30% of the total market share, both by value and volume. The European market primarily includes Germany, Poland, the Netherlands, the United Kingdom, and Italy. Among these, Germany is the second-largest export destination, holding a 12.56% share of the total export value, with an average market price of $2.55. This positions Germany as an important price-sensitive market. The UK market boasts the highest unit price in Europe at $3.48, reflecting the premium positioning of products in that market.

European markets occupy six of the top ten spots in China's overall fireworks and firecracker exports, which fully demonstrates the robust and stable demand for Chinese products across Europe. Secondly, Asian markets like Malaysia, Thailand, and Indonesia represent relatively cost-effective segments, with average market prices ranging between $2.10 and $2.62.

Overall, the main export volume of Chinese fireworks and firecrackers is concentrated in the $2-$3.5 per unit price range, covering the US, Germany, other major European countries, and most Southeast Asian nations. Naturally, competition within these mainstream price segments is relatively intense.

The data above reveals that China's fireworks and firecracker exports currently show a high degree of reliance on a single market. Dependence on the US market exceeds one-third of the total, indicating a concentration risk. Europe, as a whole, represents a market with strong and stable demand, serving as a crucial supporting pillar for China's exports.

A point requiring particular attention is the decisive impact of US tariff policies on the industry's exports. If the US maintains or imposes high tariffs on Chinese goods, such as those under Section 301, it would directly lead to increased costs, reduced competitiveness, and squeezed profit margins. Over the long term, this could potentially trigger supply chain relocation and order shifts.

In summary, China continues to hold the top position globally in both volume and value for fireworks and firecracker exports. Looking ahead, the sector is poised to leverage three key advantages—environmental upgrades, electronic control technology, and customized products for cultural tourism—to firmly maintain its triple lead in global trade in terms of "volume, price, and technology." It remains an irreplaceable core within the global festive economy's supply chain and a significant exporter of cultural IP.

As China's first data company, Big Trade Data provides import and export customs data for over 90 countries from 2010 to the present. It enables online, precise analysis of market distribution, detailed transaction records of importing/exporting enterprises, specific volume-price analyses, supply cycles, and more. We offer reliable foundational data for major foreign trade enterprises and industry consulting firms.