Analysis of the Latest Import and Export Trends of Chinese Disinfectants (HS: 38089400) in 2024

“According to customs data, Chinese disinfectants (HS: 38089400) showed a sharp growth trend from 2018 to 2020, both in terms of export value and export volume. Especially in 2020, the export value surged from $116,692,656 to $2,286,441,102, a year-on-year increase of 1859.37%, while the export volume also increased by 1362.41%.”

The disinfectant industry in China holds a strong competitive advantage in cost control, production capacity, product research and development, and the completeness of the industrial chain. It can rapidly respond to market demands and provide various types of disinfectant products, including but not limited to peroxides, phenols, biguanides, quaternary ammonium salts, alcohols, iodine-containing disinfectants, chlorine-containing disinfectants, and aldehydes. These products are not only supplied to the domestic market but also exported globally, assisting many countries in addressing the hygiene and protection needs brought about by the epidemic.

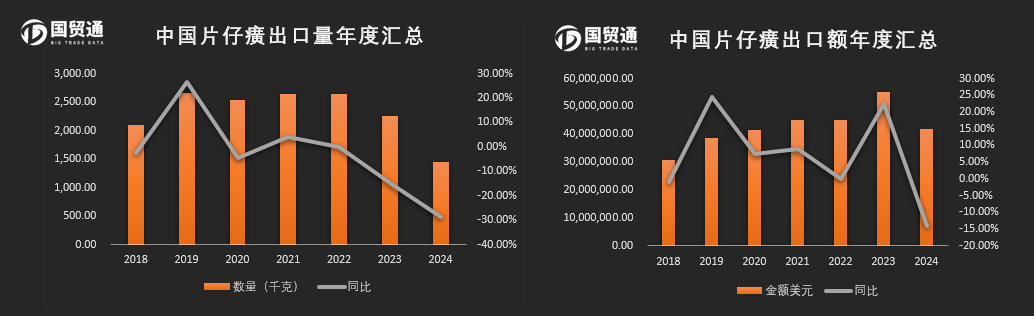

According to customs data, Chinese disinfectants (HS: 38089400) witnessed a significant growth trend from 2018 to 2020 in terms of both export value and quantity. Especially in 2020, the export value surged from $116,692,656 to $2,286,441,102, a year-on-year increase of 1859.37%, while the export quantity also increased by 1362.41%. Of course, the main reason for this growth trend is the global outbreak of the COVID-19 epidemic, which led to a sharp increase in demand for disinfection products.

Although there was a slight decline in the export of Chinese disinfectants (HS: 38089400) from 2021 to 2023, the magnitude was relatively stable. Especially in 2023, despite a 7.52% year-on-year decrease, the decline was not significant and still higher than pre-epidemic levels. This indicates that the demand for disinfectants (HS: 38089400) has entered a new equilibrium stage, no longer experiencing the sharp increase seen during the epidemic period but trending towards stability.

The export market for Chinese disinfectants is extensive, covering multiple regions including Asia, Europe, the Americas, and others. Particularly in response to sudden public health emergencies, such as in markets like the United States, the United Kingdom, Japan, Canada, Australia, Singapore, Hong Kong (China), the Netherlands, the Philippines, Chile, and others, Chinese disinfectant products are purchased by numerous countries and regions due to their effectiveness and cost-effectiveness advantages.

With the increasing awareness of environmental protection and the promotion of the concept of sustainable development, green disinfection products represented by oxidative potential water are gradually entering the market. These products meet stricter environmental standards and may become new growth points for foreign trade in the future.

It is worth noting that specific export countries, amounts, and growth rates require reference to the latest customs statistics or industry research reports for real-time information. As market dynamics and global health and epidemic prevention demands change, the foreign trade situation of Chinese disinfectants will also adjust accordingly.

As the first data company in China, Guomao Tong can provide customs data for imports and exports from more than 80 countries since 2010. It can accurately analyze the distribution of import and export markets online, as well as detailed transaction information of import and export enterprises, specific quantity-price analysis, supply cycles, etc. It provides reliable data for major foreign trade enterprises and industry consulting firms.

(This article is an original creation by Guomao Tong. Please indicate the source when reposting.)