Analysis Report on China's Activated Carbon (HS: 380210) Import and Export

“Although the export value in 2023 slightly decreased compared to 2022, as of June 2024, China's activated carbon export volume has increased by 6.23% compared to the same period in 2023.”

Activated carbon is a porous material primarily composed of carbon, characterized by a highly developed internal pore structure. These pores give activated carbon an extremely high surface area, typically ranging from hundreds to thousands of square meters per gram. This unique structure endows it with strong adsorption capabilities, enabling it to absorb impurities, colors, odors, microorganisms, and some heavy metals from various gases and liquids. Activated carbon is widely used in water treatment, air purification, the food industry, the pharmaceutical field, chemical protection, and gold recovery, among other applications.

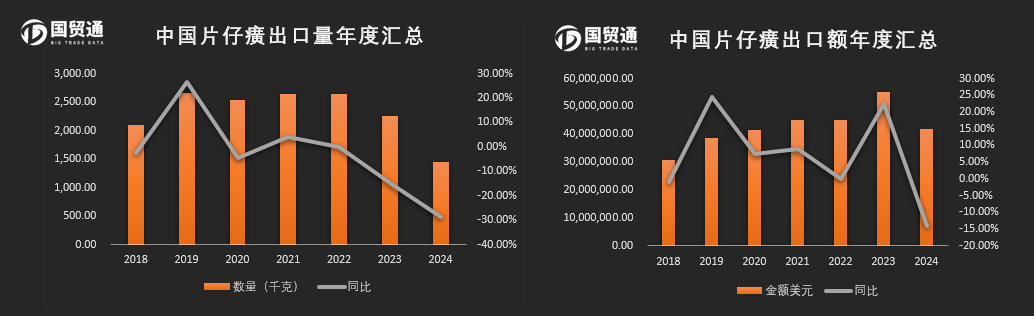

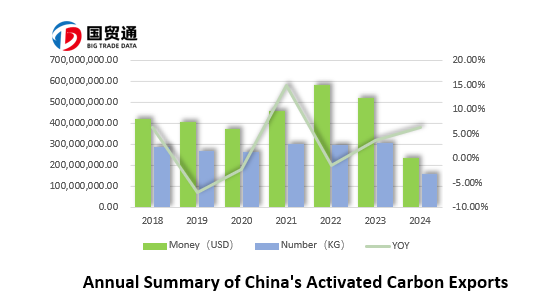

China is one of the largest producers and exporters of activated carbon globally, with its industry holding a significant position in the international market. In recent years, driven by increased environmental awareness and growing demand for efficient filtration materials across various industries, China’s activated carbon exports have risen steadily. Although there were slight fluctuations between 2018 and 2023, the overall export value and volume have shown an upward trend. Notably, in 2021 and 2022, export values reached $369 million and $457 million, with year-on-year growth rates of 23.96% and 27.02%, respectively, indicating significant overall growth. This reflects strong international demand for Chinese activated carbon.

Despite a slight decline in export value in 2023 compared to 2022, as of June 2024, the export volume of China’s activated carbon has increased by 6.23% compared to the same period in 2023. For activated carbon producers and exporters, the data from the first half of 2024 might signal the need to continue focusing on product quality improvement, market diversification strategies, and refined management of export markets to further consolidate and expand market share.

China's activated carbon has gained competitiveness in the international market due to its cost advantage, particularly when compared to other major producers like the United States and India. China's production costs are relatively lower, making its export prices more competitive.

According to customs data, over the past five years, China's activated carbon exports have been primarily concentrated in regions such as Japan, South Korea, Belgium, Italy, Germany, India, the Netherlands, the United States, Taiwan, and the United Kingdom. These markets have a high demand for high-quality activated carbon, especially in industrial and domestic water treatment. With the increasing global demand for environmentally friendly products, the export outlook for China's activated carbon is promising, particularly in emerging markets in the Asia-Pacific, Africa, and Latin America, where there is significant growth potential.

Although China's activated carbon exports also face challenges such as price competition and market access, advancements in technology and supportive policies are expected to further enhance the quality and competitiveness of these exports. In the future, green production and sustainable development will be key directions for China's activated carbon exports. Against the backdrop of rising global demand for environmentally friendly materials, China's activated carbon industry is poised for more growth opportunities.

Guomaotong, as China's first data company, can provide customs data for over 80 countries since 2010. It offers precise online analysis of import and export market distribution, detailed transaction information of import and export companies, specific quantity and price analysis, supply cycles, and more. This provides reliable data for major foreign trade enterprises and industry consulting companies.

(This article is an original creation by Guomao Tong. Please indicate the source when reposting.)