2024 China Tumble Dryers (HS Code: 842112) Import and Export Analysis

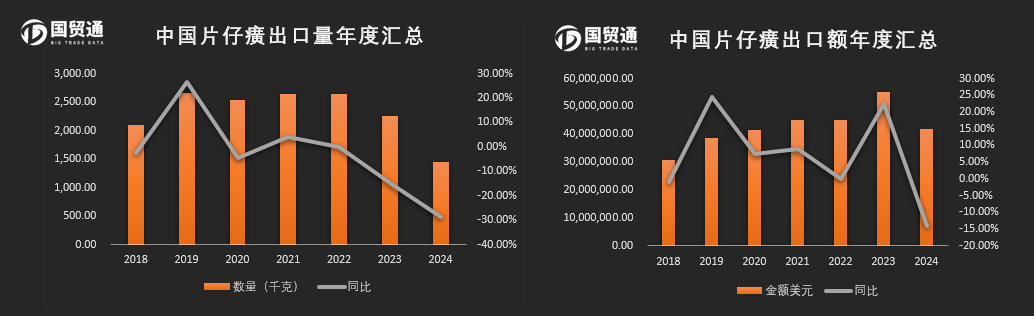

“According to customs data, the export value of Pien Tze Huang has shown a significant upward trend from 2018 to 2023. The export amount in 2018 was 30.95 million US dollars, and it will increase to 55.15 million US dollars by 2023, a year-on-year increase of 22.25% compared to 2022. From 2018 to 2023, the brand has grown by 78.2%, reflecting the expanding influence and demand of Pien Tze Huang in the international market. Its brand value and product recognition are constantly improving, attracting more and more overseas consumers and distributors.”

As of 2024, China's import and export dynamics for tumble dryers (HS code 842112) have continued to reflect the country's growing role in the global home appliance market. This analysis is based on the latest available trade data and trends, providing an overview of China's position in the global market for tumble dryers.

1. Overview of China’s Tumble Dryer Market

Tumble dryers (HS: 842112) are used to dry clothes, towels, and other fabrics through a rotating drum mechanism. The Chinese market is a major player in both the production and consumption of tumble dryers, with a significant manufacturing base and increasing domestic demand.

Domestic Consumption: In recent years, China's growing middle class and urbanization have led to an increased demand for household appliances, including tumble dryers. However, tumble dryers are still less common in Chinese households compared to other regions like Europe or North America, where they are more of a staple due to lifestyle and weather conditions.

Manufacturing Hub: China remains one of the largest producers and exporters of tumble dryers globally, benefiting from low production costs, large-scale manufacturing infrastructure, and advanced technology adoption.

2. China’s Exports of Tumble Dryers (HS: 842112)

Export Trends in 2024:

Primary Export Destinations: China’s key export markets for tumble dryers include the United States, European Union, Japan, and Southeast Asia. Among these, the United States remains the largest importer, owing to the high demand for household appliances. The European market, especially Germany and the UK, is another significant destination for Chinese tumble dryers.

Export Growth: Exports of tumble dryers from China have been relatively strong in 2024, driven by several factors:

Competitive Pricing: Chinese manufacturers continue to dominate due to their ability to offer high-quality products at lower prices compared to European and American counterparts.

Technological Advancements: The shift towards energy-efficient and smart home appliances has also bolstered demand. Chinese manufacturers have increasingly adopted these technologies, which has enhanced their competitiveness in global markets.

Trade Agreements: China's participation in free trade agreements (FTAs) with ASEAN countries, and its role in regional economic partnerships such as the Regional Comprehensive Economic Partnership (RCEP), has made exports to neighboring countries more attractive.

Top Export Markets for China’s Tumble Dryers in 2024 (Estimated Share by Value):

United States: 30-35%

Germany: 10-15%

UK: 8-12%

France: 5-8%

Japan: 5-7%

Other Asian Markets (South Korea, ASEAN countries): 15-20%

3. China’s Imports of Tumble Dryers (HS: 842112)

Import Trends in 2024:

Limited Import Volume: China is predominantly a net exporter of tumble dryers and imports a relatively small volume compared to its export activity. However, there are niche areas where imports are necessary, such as high-end, technologically advanced models from Europe or the US that meet specific consumer preferences for premium features like Wi-Fi connectivity, special drying cycles, or unique designs.

Trade Partners for Imports:

Germany and South Korea are the main exporters of high-quality tumble dryers to China. European brands such as Bosch and Miele remain prominent, as they have strong brand recognition and cater to higher-end domestic demand in urban areas.

United States: American brands like Whirlpool and General Electric also maintain a presence, though their market share in China is smaller due to local competition and different consumer preferences.

Key Reasons for Imports:

High-End Consumer Demand: A small but growing segment of China's urban population seeks premium, energy-efficient, and technologically advanced appliances that are often imported.

Technological Innovation: Some of the imported dryers feature cutting-edge technologies (e.g., heat pump dryers, smart sensors, advanced drying modes) that are not yet fully developed by local manufacturers.

4. Key Drivers of China’s Trade in Tumble Dryers

Technological Development:

The push for energy efficiency, eco-friendly technologies, and smart appliances is significantly shaping the global and Chinese tumble dryer markets. Manufacturers are increasingly integrating IoT (Internet of Things) capabilities, allowing consumers to control dryers via smartphones or integrate them with smart home systems. The ability to use energy-saving heat pump dryers, which are particularly popular in Europe, has been a significant driver for exports.

Shifting Consumer Preferences:

As urbanization continues, especially in second- and third-tier cities, more Chinese households are moving towards purchasing tumble dryers, particularly in areas with high humidity and colder climates, such as northern China.

Government Regulations:

China's energy efficiency standards and environmental regulations have played a role in pushing manufacturers to adopt more sustainable technologies. Policies favoring energy-efficient appliances, as well as the growing trend of eco-conscious consumer behavior, have contributed to both domestic demand and exports of energy-efficient tumble dryers.

5. Challenges and Opportunities

Challenges:

Domestic Market Penetration: Despite the growth, tumble dryers are still not as commonly used in China compared to other regions. The high cost of electricity, small living spaces, and the general climate in many parts of China (hot and humid in the south, cold and dry in the north) limit their appeal in some regions.

Rising Labor and Material Costs: Chinese manufacturers face increasing labor and material costs, which could affect price competitiveness. Additionally, global supply chain disruptions have impacted the availability of components like microchips used in smart appliances.

Opportunities:

Rising Middle-Class Income: As disposable income rises in urban areas, Chinese consumers are increasingly willing to invest in household appliances like tumble dryers.

Global Demand for Smart Appliances: China can leverage its strong electronics and technology sectors to integrate more smart features into its tumble dryers, meeting global demand for connected devices.

Sustainability Trends: With the growing global emphasis on sustainability, manufacturers can focus on producing energy-efficient models to meet both domestic and international consumer demands.

Conclusion:

China continues to be a dominant player in the tumble dryer market, both as an exporter and producer. While domestic consumption is growing, exports to key markets like the U.S. and Europe remain a major source of revenue for Chinese manufacturers. Innovations in technology and energy efficiency are crucial to maintaining competitiveness, especially as global demand for smart, sustainable appliances rises.