China Casein (HS: 35011000) Latest Import and Export Analysis for 2024

“Customs data indicates that from January to July 2024, the total import and export volume of casein reached 12,883,330 kilograms, with a total value of USD 100,229,174. Specifically, the export volume amounted to 1,315,030 kilograms, marking a decrease of 16.95% year-over-year. Notably, exports in July witnessed a significant increase of 257.84% compared to the same period the previous year. The total export value was USD 1,232,897, down by 37.61% year-on-year; however, July saw a growth of 116.07% compared to the same month last year. On the import side, the total volume was 12,751,827 kilograms, representing a rise of 11.33% compared to the prior year. The total import value stood at USD 98,996,277, experiencing a decline of 35.96% year-over-year.”

Casein, as a vital component of non-food dairy products (HS Code 35011000), plays a pivotal role in China's food industry, feed additives, biopharmaceuticals, and other sectors. This report centers on the import and export landscape of China's casein market in 2024, utilizing comprehensive data analysis and market trend insights to reveal dynamics and opportunities for related enterprises and investors.

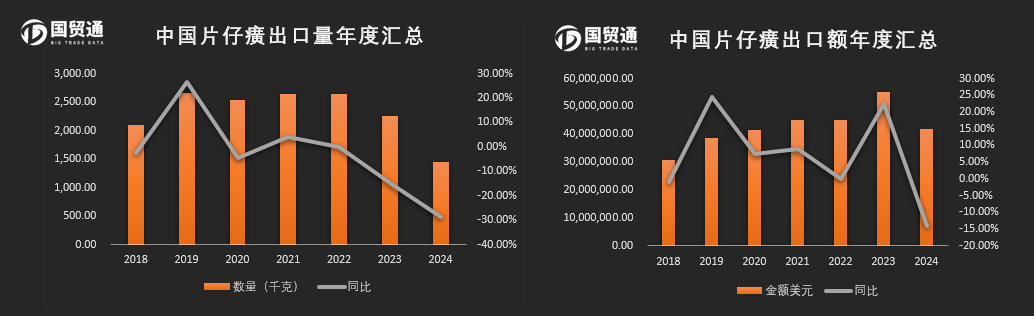

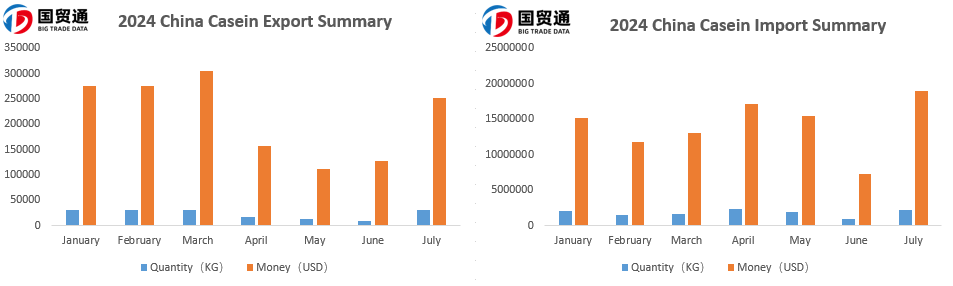

Customs data indicates that from January to July 2024, the total import and export volume of casein reached 12,883,330 kilograms, with a total value of USD 100,229,174. Specifically, the export volume amounted to 1,315,030 kilograms, marking a decrease of 16.95% year-over-year. Notably, exports in July witnessed a significant increase of 257.84% compared to the same period the previous year. The total export value was USD 1,232,897, down by 37.61% year-on-year; however, July saw a growth of 116.07% compared to the same month last year. On the import side, the total volume was 12,751,827 kilograms, representing a rise of 11.33% compared to the prior year. The total import value stood at USD 98,996,277, experiencing a decline of 35.96% year-over-year.

From the data presented, it is evident that China's casein imports and exports exhibit a fluctuating yet ascending trend, primarily fueled by increased production capacity and quality enhancements within the domestic dairy industry. Despite intensified international competition, China's casein, leveraging its cost-effectiveness and continuously improving product quality, is expanding its market share across Asia, particularly in countries such as South Korea, Vietnam, Malaysia, the Philippines, Pakistan, and Indonesia.

Regarding imports, there is a diversification in the types of casein being imported, including skimmed milk powder, whey protein concentrate, and lactoferrin, among others, to cater to the varying demands of different niche markets. In an effort to ensure supply chain security, China is gradually broadening its list of importing countries to mitigate reliance on any single market. Amidst rising domestic consumption upgrading and health consciousness, the demand for high-quality and specialty caseins is surging. Consequently, large volumes of casein are imported from traditional dairy powerhouses like New Zealand, the Netherlands, Belarus, Spain, Poland, to cater to the manufacturing needs of premium food products, nutritional supplements, and specialized medical foods.

It is projected that the Chinese casein market will maintain its growth trajectory in the coming years, especially within the realms of health foods and specialized nutrition products. Technological innovation and product differentiation will be crucial factors in the competitive landscape for businesses operating in this sector.

In summary, China's casein import and export market displays robust growth potential and vitality. Amidst the complexities of the global market, staying informed about the latest trade data on casein, grasping trends, and refining strategies are vital for the sustained development of China's casein industry.

As the first data company in China, Guomao Tong provides customs data on imports and exports from over 80 countries since 2010. It offers online precision analysis of market distributions, detailed transaction information of importing and exporting companies, specific quantity-price analyses, and supply cycle details. This serves as a reliable basis of data for major foreign trade enterprises and industry consulting firms.

(This article is an original creation by BTD. Please indicate the source when reposting.)