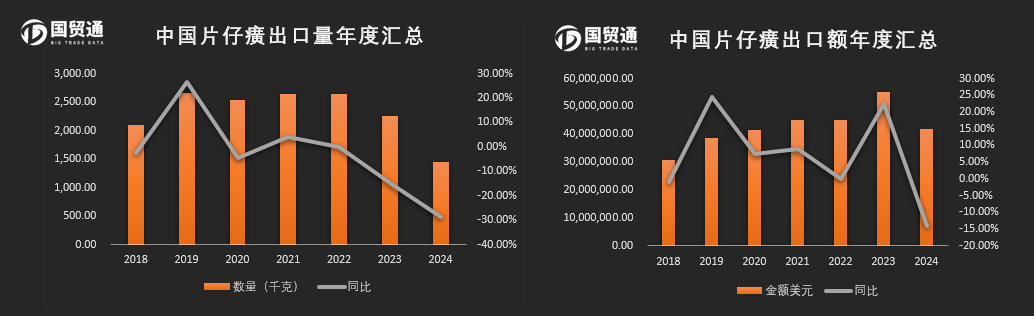

China Glycerol (HS: 29054500) Latest Import and Export Analysis for 2024

“According to customs data, from 2018 to May 2024, the total export value amounted to $46.54 million, with a total export volume of 30,000 tons. In contrast, the total import value was $2.296 billion, with a total import volume of 3.042 million tons.”

Glycerin, also known as propane-1,2,3-triol or丙三醇 in Chinese, is a versatile compound widely used in pharmaceuticals, cosmetics, food processing, and various other industrial sectors. Owing to its unique chemical properties and biocompatibility, glycerin plays a crucial role across numerous industries.

As global demand for health products, beauty items, and high-quality chemical products rises, glycerin (丙三醇) stands out as a significant chemical raw material and additive, reflecting a steady increase in worldwide demand. Its applications, particularly in the cosmetics, food, and pharmaceutical industries, are expanding, driving market growth.

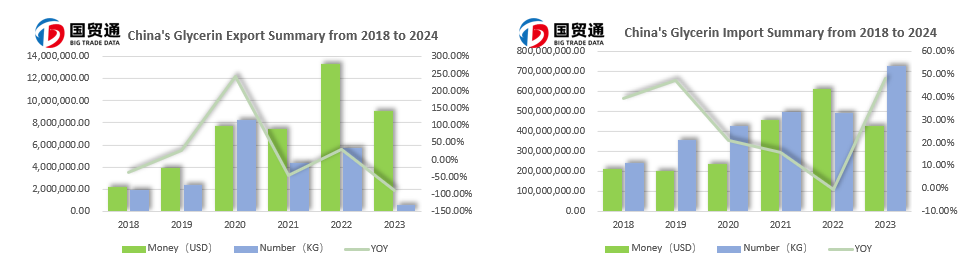

China, as a global manufacturing powerhouse, has substantial requirements for glycerin, especially in the food, pharmaceutical, cosmetic, and chemical industries. The rapid development of these sectors fuels a persistent rise in the need for glycerin as a raw material, necessitating large imports to fulfill domestic market demands. China experiences a trade deficit in glycerin (丙三醇) trade.

Customs data reveals that, from 2018 up until May 2024, the cumulative export value reached USD 46.54 million for a total exported volume of 30,000 tons. Conversely, the cumulative import value amounted to USD 2.296 billion for an imported volume of 3.042 million tons. While showing an overall upward trend, the figures for January to May 2024 show a decline in exports, with a total of 1,865 tons, down 17.20% compared to the same period the previous year. Meanwhile, the total import volume for the same period was 309,700 tons, marking a 3.45% increase year-over-year. Notably, in 2022, imports surged to 612,700 tons, representing a 34.09% increase compared to the previous year, highlighting the continued reliance on imports to meet China's growing demand for glycerin.

China's glycerol (glycerin) import and export trade partners are widely distributed, covering countries from multiple continents. Exports are primarily to Japan, North Korea, Taiwan, South Korea, and the Netherlands, mostly concentrated in neighboring Asian countries. This indicates that regional trade is a significant component, highlighting China's influence in the Asian market.

Imports, on the other hand, are mainly from Indonesia and Malaysia, accounting for 81.63% of the total import volume. Indonesia, as the primary supplier, represents 62.39% of the total imports, making it a crucial source for China's glycerol needs, particularly in industries such as chemicals, pharmaceuticals, and cosmetics.

These data show that China’s glycerol trade activities are closely linked with Asian countries, but there are also connections with Europe and the Americas. For example, the Netherlands, the United States, and Russia account for 15.38% of China's total exports. In terms of imports, Brazil and Argentina make up 12.76% of the total import volume. Additionally, emerging markets like Nicaragua, Peru, Ireland, Norway, Laos, and Bulgaria have developed over the past few years.

It is noteworthy that China shows a trade deficit in glycerol, indicating that its import volume exceeds its export volume. This is related to China's high demand for glycerol as a global manufacturing hub, highlighting the insufficiency of domestic production and supply relative to demand. As China continues to promote economic transformation and upgrade policies such as the Belt and Road Initiative, its role and trade partner distribution in the global glycerol supply chain may further evolve.

For foreign trade enterprises, glycerol data is crucial for strategic planning, optimizing business decisions, and enhancing market competitiveness. In today's increasingly complex and volatile global trade environment, precise data analysis is essential for corporate success.

Guomaotong, as China’s first data company, can provide customs data on imports and exports from over 80 countries since 2010. It offers precise online analysis of market distribution, detailed trading conditions of import and export enterprises, specific volume and price analysis, supply cycles, and more, providing reliable data for major foreign trade enterprises and industry consulting companies.

(This article is an original creation by Guomao Tong. Please indicate the source when reposting.)