China's Surfactants (HS Code: 34024) Latest Export Analysis for 2025

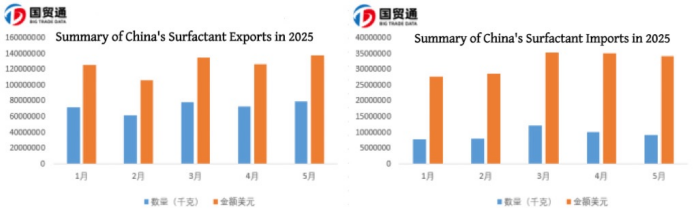

“In recent years, China's surfactant market has continued to grow. According to customs data, the total export value from January to May 2025 reached $631 million. Monthly export figures exhibited a "V-shaped" fluctuation pattern. Compared to the baseline in January, exports declined by 10.5% and 5.7% in February and April, respectively, while March and May saw increases of 27.1% and 8.3%.”

Surfactants are compounds that significantly reduce the surface tension of liquids and are widely used in various industries. The detergent industry is the largest application field, accounting for approximately 51% of total usage. Anionic surfactants (such as AES and LAS) and nonionic surfactants (such as AEO) are commonly used in the production of laundry detergents, dishwashing liquids, and other cleaning products.

In recent years, China's surfactant market has continued to grow. According to customs data, the total export value from January to May 2025 reached $631 million. Monthly export figures exhibited a "V-shaped" fluctuation pattern.Compared to the baseline in January, exports declined by 10.5% and 5.7% in February and April, respectively, while March and May saw increases of 27.1% and 8.3%.

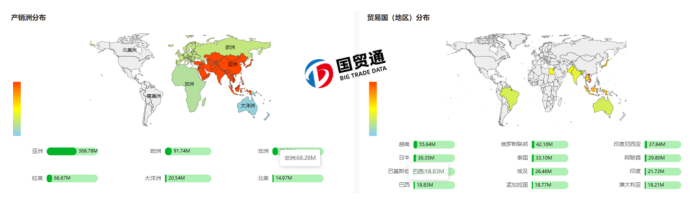

Market Distribution

China's surfactant exports are primarily concentrated in Vietnam, Russia, Thailan , Indonesia, and Japan, accounting for 10.5%, 8.0%, 6.3%, 7.1%, and 6.9% of total exports, respectively.

Regional Trends

Asia remains the core market, contributing 54.2% of total exports, with Vietnam, Thailand, and Indonesia being key destinations.Russia, due to Western sanctions, has increased its import demand from Asia.A notable emerging market is the UAE, where surfactant exports surged to $10.59 million in May, making up 4.72% of total exports, partly driven by infrastructure projects in the Middle East.

Challenges in Traditional Markets

The U.S., affected by tariff policies, saw a continuous decline in exports, dropping to 22nd place with a 49.6% decrease from January to May.Germany and France each hold less than 5% of the market share.Markets like Russia and Iran are highly susceptible to international sanctions, while emerging economies such as Argentina and Turkey face currency instability, posing trade risks.

Industry Trends

With the tightening of "dual-carbon" policies and environmental regulations, traditional surfactants (e.g., certain anionic types) face substitution pressures. The development of green and biodegradable alternatives has become an inevitable trend.

Conclusion

China's surfactant industry is transitioning from "quantity expansion" to "quality enhancement." Future growth depends on technological breakthroughs, industrial structure optimization, stricter environmental compliance, and expansion into high-value applications. Companies must focus on innovation, green transformation, and differentiated competition to secure a stronger position in the global market.

Note: This analysis covers cationic, nonionic, and other organic surfactants under HS:34024, including sub-codes HS:34024100, HS:34024200, and HS:34024900.

China Big Trade Data Surfactant Trade Country Dashboard:

China Big Trade Data Importer Portfolio:

China Big Trade Data Thailand Market Data Dashboard:

China Big Trade Data Limited(BTD), as China's first data intelligence provider, offers import-export customs data for over 90 countries from 2010 to the present, enabling precise analysis of market distribution, enterprise transaction details, pricing trends, supply cycles, and more. We provide reliable, data-driven insights for foreign trade enterprises and industry consultants.