Imports from China Surge 52%, Profits Double: This Central Asian "Dark Horse" Is Booming

“From January to May 2025, China-Uzbekistan trade reached $5.4 billion, an 8% increase compared to the same period in 2024, solidifying China’s position as Uzbekistan’s top trading partner. This data reflects both Uzbekistan’s rapid economic development and the deepening, mutually beneficial trade ties between China and Uzbekistan.”

China is expanding its global market presence with its strong manufacturing prowess, with its products holding a dominant position in international trade—over 90% of electric vehicles, 82% of smartphones, and 90% of home appliances come from China. Meanwhile, economic and trade cooperation between China and Uzbekistan is deepening, with China now accounting for 17.7% of Uzbekistan’s foreign trade, making it the largest trading partner for this "double-landlocked" Central Asian nation. This highlights Uzbekistan’s strategic value as a high-potential market for Chinese businesses.

【The Strategic Signals Behind the Data】

From January to May 2025, China-Uzbekistan trade reached $5.4 billion, an 8% increase compared to the same period in 2024, solidifying China’s position as Uzbekistan’s top trading partner.

Following China are Russia ($4.8 billion), Kazakhstan ($1.7 billion), Turkey ($1 billion), and South Korea ($710 million). These figures not only demonstrate the strong foundation of China-Uzbekistan trade but also reflect the high competitiveness and growing demand for Chinese products in the Central Asian market.

According to the World Investment Report 2024 released by UNCTAD in June, Uzbekistan attracted $2.8 billion in FDI in 2024, marking significant growth and ranking first among Central Asian countries for the first time in 30 years.

This data reflects both Uzbekistan’s rapid economic development and the deepening, mutually beneficial trade ties between China and Uzbekistan.

【Why Uzbekistan】

Uzbekistan is the second-largest economy in Central Asia after Kazakhstan. As a "double-landlocked" country—meaning neither it nor any of its five neighboring countries have direct sea access—it relies heavily on overland trade routes. With a population of around 38 million, it is the most populous nation in Central Asia.

As an ancient Silk Road hub, Uzbekistan serves as a critical node for the China-Europe Railway Express, connecting markets in Russia, Kazakhstan, and beyond. Its natural logistics advantage will be further enhanced when the China-Kyrgyzstan-Uzbekistan Railway opens in 2026, significantly reducing transportation costs.

On the policy front, foreign companies in Uzbekistan’s free economic zones can enjoy up to 10 years of tax exemptions, followed by a 50% reduction in income and unified taxes. Additionally, imported raw materials, supplies, and components are exempt from tariffs (only customs fees apply), significantly lowering production costs for manufacturing firms reliant on imported materials.

In January 2025 alone, Uzbekistan attracted $3 billion in foreign investment, a 40% increase year-on-year. With its Silk Road connectivity and abundant resources, Uzbekistan is becoming a golden springboard for Chinese companies expanding into Central Asia.

【What Does China Export to Uzbekistan】

China exports a wide range of goods to Uzbekistan—over 4,600 categories (based on 8-digit HS codes). The top exports include:Machinery & electronics,Transportation equipment,Metal products,Textiles、 footwear and apparel,Plastics & rubber products.

"Top Products Exported from China to Uzbekistan (January-June 2025)"

Key Opportunity Sectors for Exporters (2025-2026):

✅ Manufacturing

Manufacturing now accounts for 27% of Uzbekistan’s GDP (up from 20% five years ago), with rapid growth in food processing, building materials, and automotive assembly. Chinese, Japanese, Turkish, and South Korean firms are accelerating this trend.

✅ Construction & Urban Development

Uzbekistan’s urbanization is accelerating, with plans to build 135,000 apartments (8.1 million sqm) in 2025 alone—creating huge opportunities for Chinese building materials and home furnishing suppliers.

✅ Agriculture & Processing

As a traditional agricultural hub, Uzbekistan is modernizing rapidly, creating investment potential in sorting, packaging, cold-chain logistics, and integrated processing solutions.

✅ New Energy

Uzbekistan declared 2025 the "Year of Environmental Protection and Green Economy," targeting 19,000 MW of new renewable capacity by 2030. Solar + storage companies will see major growth in the coming years.

✅ Digital Economy

The Uzbek government is pushing its "Digital Uzbekistan 2030" plan, aiming for 95% internet coverage and positioning itself as Central Asia’s digital finance hub. Cross-border data restrictions have been relaxed, and foreign investment in data centers, telecom infrastructure, and digital services is encouraged.

With bold economic reforms, geopolitical advantages, and a young, growing population, Uzbekistan is emerging as Central Asia’s new blue ocean.

China Big Trade Data Ltd. Offers high-quality databases covering Uzbekistan and all five Central Asian countries, helping exporters:

✔ Rapidly identify high-value clients

✔ Conduct in-depth customer background analysis

✔ Track competitors and seize market opportunities

For businesses looking to enter Uzbekistan, China Big Trade Data Ltd. ’s AI-powered DaaS system can precisely filter and target the most promising buyers.

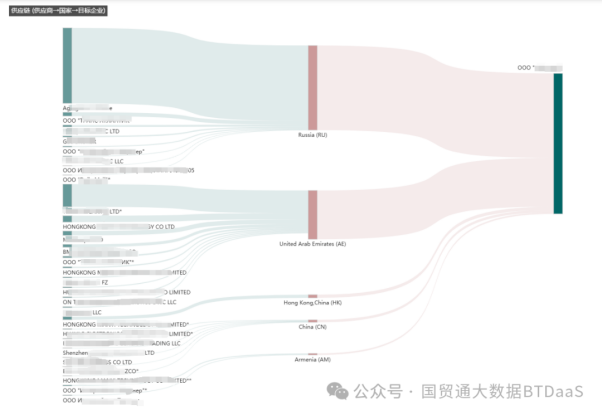

Smartphone Buyers in Uzbekistan:

Supply Chain Analysis (Uzbekistan):

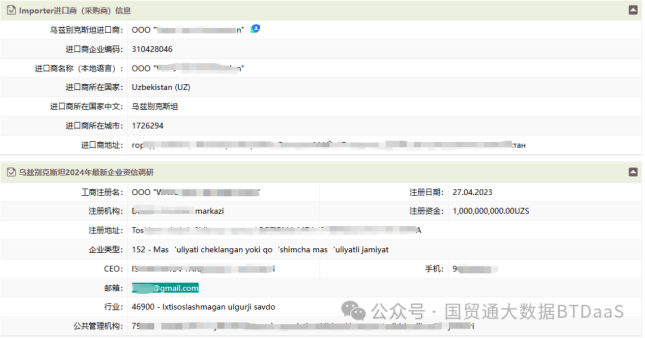

Corporate Creditworthiness:

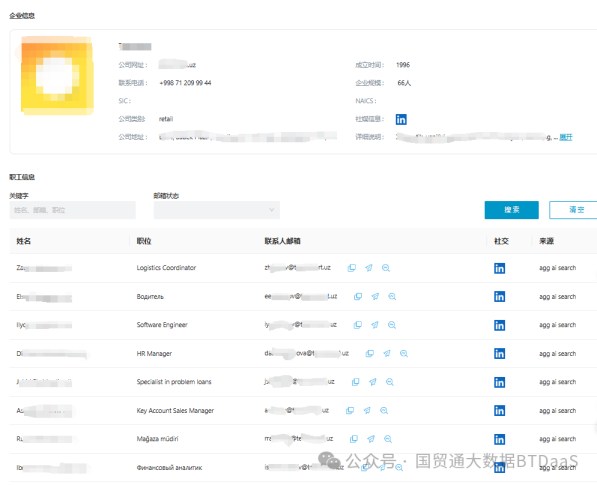

Gain in-depth insights into your target clients' trade activities, transaction records, supply chains, corporate creditworthiness, and key contacts. Progress from preliminary research to deep engagement, enabling precise targeting of Uzbek customers.

Across the desert, solar panels flicker under the sun; on automobile assembly lines, machines hum ceaselessly day and night; in traditional bazaars, QR codes silently pulse with a modern glow. A wave of prosperity—fueled by policy incentives and market gaps—is surging across Uzbekistan. For Chinese enterprises, Uzbekistan is no longer just a resource exporter but an emerging market with a rapidly industrializing economy.