GTD Newsflash: Attention for Solar Exporters to Southeast Asia

“On May 14, the United States, in a recent move, announced its intention to impose additional tariffs on $18 billion worth of Chinese imports.”

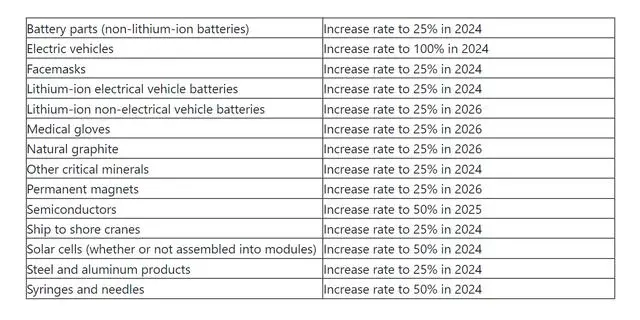

On May 14, the United States, in a recent move, announced its intention to impose additional tariffs on $18 billion worth of Chinese imports. Based on the quadrennial review report submitted by the Office of the U.S. Trade Representative (USTR) on that day, the Biden administration not only largely upheld the existing Section 301 tariffs on China in terms of items and rates but also vowed to escalate measures by imposing new Section 301 tariffs or significantly raising existing rates on a range of products imported from China, including steel and aluminum, semiconductors, electric vehicles, lithium-ion batteries, solar products, port cranes, and certain medical devices. This includes adjusting the tariff rate on electric vehicles from 25% to 100% within the year, increasing the rate on lithium-ion power batteries from 7.5% to 25%, and elevating the tariff on photovoltaic cells from 25% to 50%, all aimed at "shielding American workers and companies from the impacts of China's unfair trade practices." Just two days later (on May 16), the United States announced that the duty-free policy for certain solar products imported from Cambodia, Malaysia, Thailand, and Vietnam, which began in June 2022, will conclude after its expiration on June 6 this year. The tariff exemption for bifacial solar panels under the Section 201 policy will be immediately terminated. However, for existing contracts that can be fulfilled within 90 days of the announcement to revoke the exemption, the current tariff exemption policy will still apply. According to the present policy, the Section 201 tariff rate on bifacial solar panels stands at 14.25%。 Within the tariff policy for imported solar products from the four Southeast Asian nations, the US Department of Commerce had also mandated that panels imported duty-free must be installed within 180 days to prevent stockpiling in the domestic market. US Customs has already announced that it will actively enforce this provision, requiring importers to provide certification that these products have been installed and utilized. Furthermore, in response to a petition filed by the American Alliance for Solar Manufacturing Trade Committee on April 24, 2024, the US Department of Commerce has initiated anti-dumping and countervailing duty investigations on crystalline silicon photovoltaic cells (whether or not assembled into modules) imported from Cambodia, Malaysia, Thailand, and Vietnam. This investigation covers products classified under US Harmonized Tariff Schedule codes 8541.40.6025, 8541.42.0010, 8541.40.6015, and 8541.43.0010, as well as certain products under codes 8541.40.6015 and 8541.43.0010. The U.S. International Trade Commission (ITC) is expected to make a preliminary determination regarding injury to the domestic industry no later than June 10, 2024. Early this month, the US Department of Commerce has just announced its preliminary anti-dumping and countervailing duties (AD/CVD) ruling on solar mounting systems, another major cost component in photovoltaic installations, with China-facing products set to be subjected to tariffs as high as 376.85%. Over the years, the United States has persistently sought to encircle China's photovoltaic products with a series of measures including anti-dumping and countervailing duties (AD/CVD), Section 301 tariffs, Section 201 safeguards, and withhold release orders (WROs), rendering direct exports of Chinese photovoltaics to the U.S. virtually negligible. In Southeast Asia, the United States applies a "Silicon Wafer + 3" rule, which stipulates that if a solar module incorporates at least three out of key auxiliary materials such as silver paste, glass, backsheet, and others from regions outside of China—in addition to the silicon wafer—the product is considered a合格的 locally made PV product in Southeast Asia, devoid of circumvention behavior, and thus eligible for exemption from anti-dumping and countervailing (AD/CVD) duties. Over the past two years, Chinese companies, in alignment with this rule, have significantly upgraded their supply chain setups in Southeast Asia. Consequently, when President Biden's exemption order expires in June, the majority of imports from Southeast Asian countries are expected to avoid tariffs, as Chinese firms' current supply chains are sufficiently diversified to circumvent the new restrictions. However, what Chinese companies should be mindful of is that the new anti-dumping and countervailing (AD/CVD) petition put forth by U.S. manufacturers aims to abolish the existing rule and set a higher, more challenging threshold for Chinese manufacturers, effectively undermining the arduous capacity building efforts they have undertaken in Southeast Asia over the past two years. In accordance with AD/CVD investigation procedures, once a new investigation is initiated, there is a risk that imported products may be subject to retroactive duties during the investigation period, further complicating matters for Chinese firms. Liu Yiyang, Deputy Secretary General of the China Photovoltaic Industry Association, has issued a warning, asserting that there is a high likelihood of the new AD/CVD measures being implemented in the medium to long term. He cautions the Chinese photovoltaic industry against harboring any illusions and emphasizes the need to focus on strengthening their own positions, adopting a strategy of "making themselves invincible," thereby securing a position of "invincibility." Liu also advises PV enterprises invested in the four Southeast Asian nations to proactively engage with their host country governments, leveraging legal means and international trade regulations to vigorously defend their rights through litigation.